Minnesota paycheck calculator

Our calculator has been specially developed in order to provide the users of the calculator with not only. Ad Process Payroll Faster Easier With ADP Payroll.

Minnesota Sales Tax Guide And Calculator 2022 Taxjar

How to use our Minnesota paycheck calculator First enter your hourly pay.

. The Minnesota Child Support Division bases the Child Support Guidelines Calculator on the Minnesota Child support guidelines statute which became effective Jan. Minnesota New Hire Reporting. All Services Backed by Tax Guarantee.

Employers also have to match the 62 tax dollar-for-dollar. Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax liability minus any additional tax withholdings Total annual income Tax liability All deductions Withholdings Your annual paycheck State payroll tax. Switch to Minnesota hourly calculator.

Minnesota Minnesota Salary Paycheck Calculator Results Below are your Minnesota salary paycheck results. Minnesota New Hire Reporting Center. Paid by the hour.

Minnesota Paycheck Calculator Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Calculates Federal FICA Medicare and withholding taxes for all 50 states. Our Minnesota Paycheck Calculator converts your hourly pay instantly to weekly monthly or annual wages.

Just enter the wages tax withholdings and other information required below and our tool will take care of the rest. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Get Started With ADP Payroll.

Saint Paul MN 55164-0212. Calculate your Minnesota net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Minnesota paycheck calculator. Second enter how many hours you work a week.

The Minnesota state income tax is based on four tax. Ad Payroll So Easy You Can Set It Up Run It Yourself. Minnesota Paycheck Calculator Find out how much your take home pay is after income tax so you can have a better idea of what to expect when planning your budget 7 Ratings Optional Criteria See values per.

The total cost paid by the employer and employee should be reported on the State Copy of the W-2 form in Box 12. Year Month Biweekly Week Day Hour Results Income Before Tax 0 Take Home Pay 0 Total Tax 0 Average Tax Rate 0 US Dollar 0 Net Pay 0. How many children live in each parents home do not count children who the parent has a court order to pay child support Any other child support orders for either parent.

A financial advisor in Minnesota can help you understand how these taxes fit into your overall financial goals. State Date State Minnesota. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator.

Deduct and match any FICA taxes. Switch to salary Hourly Employee. Minnesota Minnesota Gross-Up Calculator Change state Use this Minnesota gross pay calculator to gross up wages based on net pay.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. Switch to hourly Salaried Employee. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Minnesota.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. If your check date falls on this date please adjust it to avoid delaying your employees direct deposits and delivery of your payroll package. Financial advisors can also help with investing and financial plans including retirement homeownership insurance and more to make sure you are preparing for the future.

After opening the presentation you need to click the Slide Show tab and then Start Slide Show From Beginning. Net Pay Calculator PowerPoint Presentation Net Pay Calculator PowerPoint presentation Note for employees with PowerPoint 2007. For example if an employee receives 500 in take-home pay this calculator can be used to calculate the gross amount that.

Minnesota Paycheck Calculator Use ADPs Minnesota Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Social Security tax which is 62 of each employees taxable wages up until they reach 147000 for the 2022 tax year which means the maximum Social Security tax that each employee has to pay is 885360 for the year. The results are broken up into three sections.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Change state Check Date General Gross Pay Gross Pay Method.

You are able to use our Minnesota State Tax Calculator to calculate your total tax costs in the tax year 202223. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Minnesota. The Minnesota Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Minnesota State Income Tax Rates and Thresholds in 2022.

Supports hourly salary income and multiple pay frequencies. The paycheck calculator instantly converts your hourly pay to earnings per week month or year. Minnesota new hire online reporting.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Minnesota Paycheck Calculator Smartasset

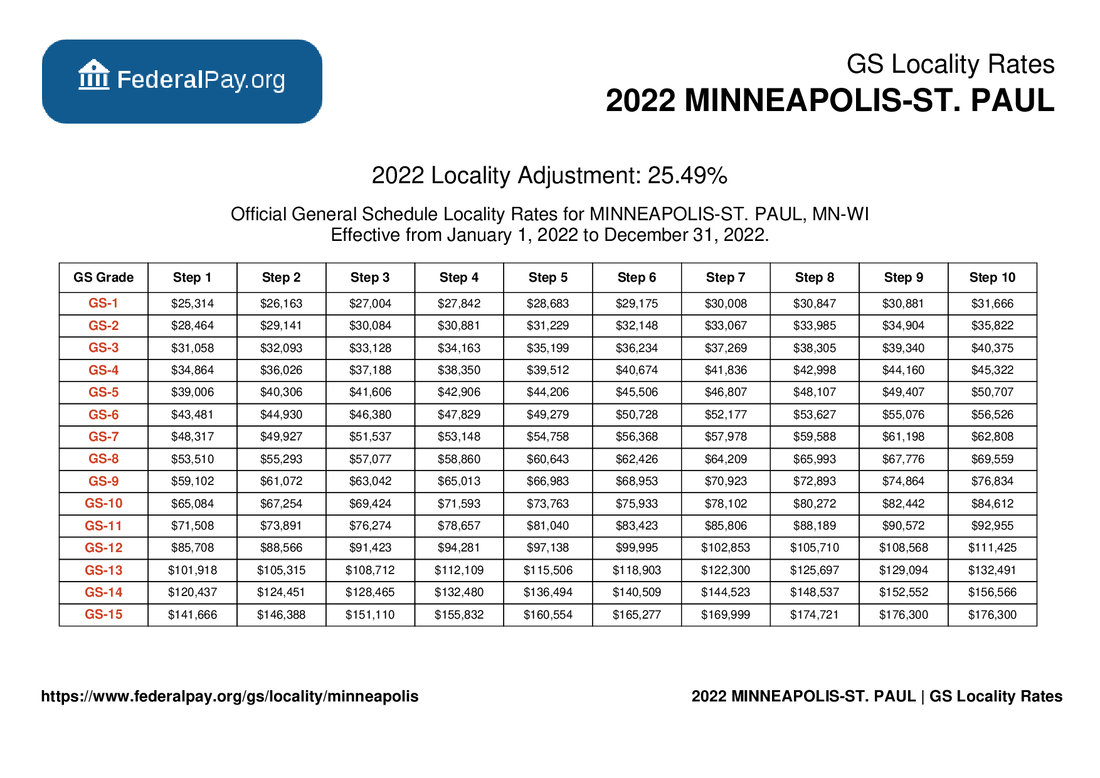

Minneapolis Pay Locality General Schedule Pay Areas

Taxation Of Social Security Benefits Mn House Research

Hennepin County Mn Property Tax Calculator Smartasset

Minnesota Federal Loan Interest Assessment How To Calculate

Tip Tax Calculator Primepay

Minnesota Last Paycheck Lawsuit Final Paycheck Laws In Minnesota

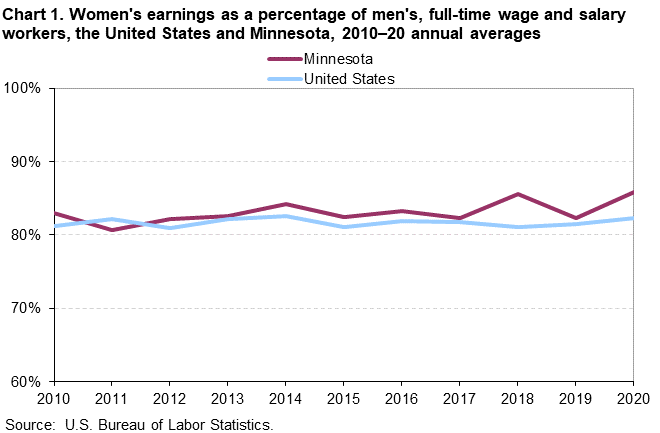

Women S Earnings In Minnesota 2020 Midwest Information Office U S Bureau Of Labor Statistics

Taxation Of Social Security Benefits Mn House Research

Minnesota Paycheck Calculator Smartasset

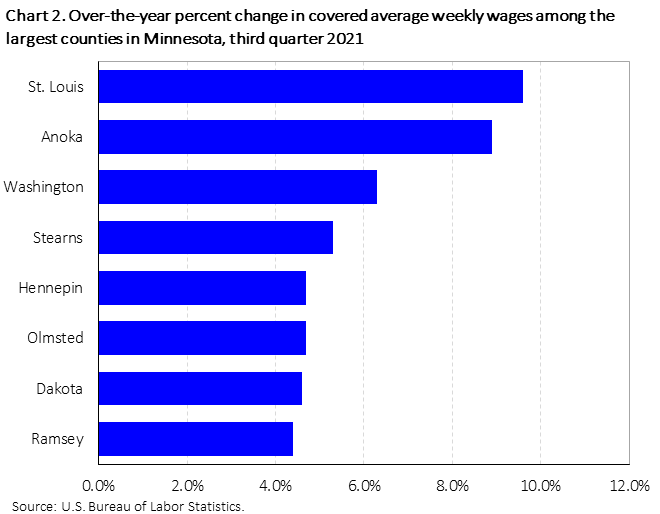

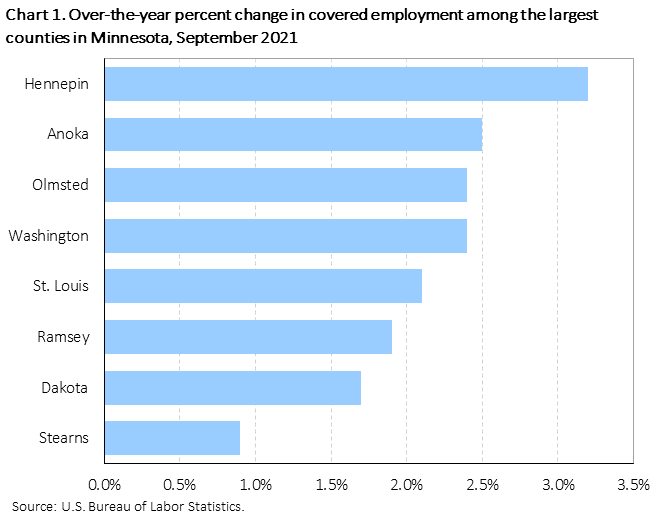

County Employment And Wages In Minnesota Third Quarter 2021 Midwest Information Office U S Bureau Of Labor Statistics

Payroll Tax Calculator For Employers Gusto

County Employment And Wages In Minnesota Third Quarter 2021 Midwest Information Office U S Bureau Of Labor Statistics

Minnesota Retirement Tax Friendliness Smartasset

Minnesota Income Tax Calculator Smartasset

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Minnesota Federal Loan Interest Assessment How To Calculate