Perpetual bond formula

The formula for calculating YTM is shown below. For example if the annual coupon of the bond were 5 and the.

Impossible Finance The Perpetual Zero Coupon Bond By Martin C W Walker Medium

How does Bond Yields effect investment decisions.

. The Black model sometimes known as the Black-76 model is a variant of the BlackScholes option pricing model. Welcome to the complete list of James Bond Watches. Perpetuity refers to an infinite amount of time.

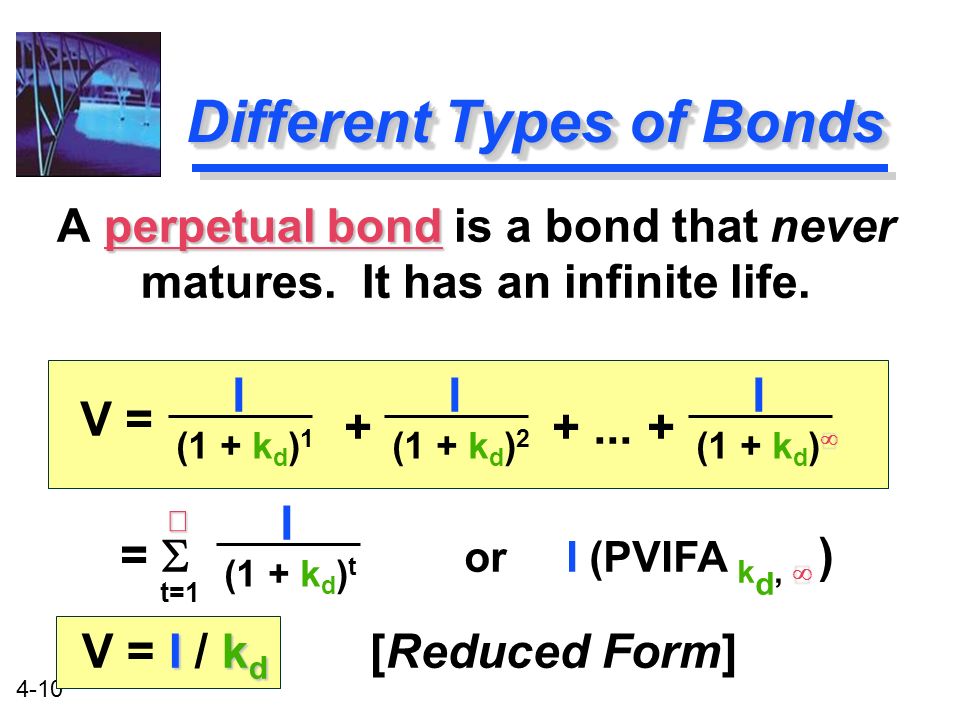

One major drawback to these types of bonds is that they are not redeemable. Where G Total amount of gratuity you can receive. A perpetual bond is a fixed income security with no maturity date.

The Rolex Oyster Perpetual is the perfect watch for anyone looking for a timeless understated watch. The sleek no-frills design is equally popular with men and women. The fixed rate hasnt been above 050 in over a decade but if you have an older savings bond your fixed rate may be up to 360.

The cost of resolving the conflicts of interest bw managers and shareholders are special types of costs. For example if the investment stated that 1000 would be issued in the following year but at a 2 growth rate then the annual cash flows would increase 2 year-over-year YoY. From Sean Connerys Rolex Submariner to Daniel Craigs Omega Planet Ocean or Seamaster aka the Casino Royale watches the James Bond franchise enjoys a rich tradition of putting serious horology up on the big screen.

Government taxes corporate income. Course Summary Accounting 101. After the 568 per cent perpetual securities were not redeemed on their first call date on July 8 2021 the distribution rate was reset at 49817 per cent per annum for the period from the first.

Today we give that tradition its due by way of our complete list of all the 007. It is an important part of the discounted cash flow formula and accounts for as much as 60-70 of the firms value and thus warrants due attention. You add the fixed and variable rates to get the total interest rate.

Given this drawback the major. Daily inflation-indexed bonds pay a periodic coupon that is equal to the product of the principal and the nominal coupon rate. Bank AT1 Perpetual Bond.

The Oyster Perpetual Date logo affixed to each model guarantees water and dust tightness as well as automatic movement while at the same time indicating the practical date functionThe Oyster Perpetual Date belongs to the cheaper. Bank AT1 Perpetual Bond. Blacks model can be generalized into a class of models known as log.

Using the official formula the variable component of interest rate for the next 6 month cycle will be 962. Tips on purchase and redemption. STATE BANK OF INDIA.

Gratuity calculation involves usage of the gratuity formula which goes as follows. N Number of years of your servicejob in the company. The concept of a.

The terminal value is calculated using the perpetual growth rate or exit multiple methods. Terminal value is the estimated business value beyond the period for which cash flows are forecasted. However for a growing perpetuity there is a perpetual growth rate attached to the series of cash flows.

Limited liability ease of ownership transfer and perpetual succession are the major advantages. Its primary applications are for pricing options on future contracts bond options interest rate cap and floors and swaptionsIt was first presented in a paper written by Fischer Black in 1976. For some bonds such as in the case of TIPS the underlying principal of the bond changes which results in a higher interest payment when multiplied by the same rate.

In finance it is a constant stream of identical cash flows with no end such as with the British-issued bonds known as consols. It is not too noticeable on the wrist but can still impress with its classic designIn addition the Oyster Perpetual is one of the more affordable watches from Rolex but without losing prestige making it perfect for beginnersThe strikingly unobtrusive Oyster Perpetual is elegant. A perpetual annuity also called a perpetuity promises to pay a certain amount of money to its owner forever.

A classic example would be that of a perpetual bond which promises to pay interest. Financial Accounting has been evaluated and recommended for 3 semester hours and may be transferred to over 2000 colleges and universities. B Last received salary Basic plus DA We can also take an example for the calculation of gratuity and understand the formula better.

The Rolex Oyster Perpetual Date is considered a classic unpretentious watch.

Discount Rate Formula How To Calculate Discount Rate With Examples

Perpetuity Yield To Maturity Youtube

Bond Valuation Professor Thomas Chemmanur 2 Bond Valuation A Bond Represents Borrowing By Firms From Investors F Face Value Of The Bond Sometimes Ppt Download

Present Value Of Growing Perpetuity Formula With Calculator

Valuation Of Securities Ppt Download

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Duration And Convexity To Measure Bond Risk

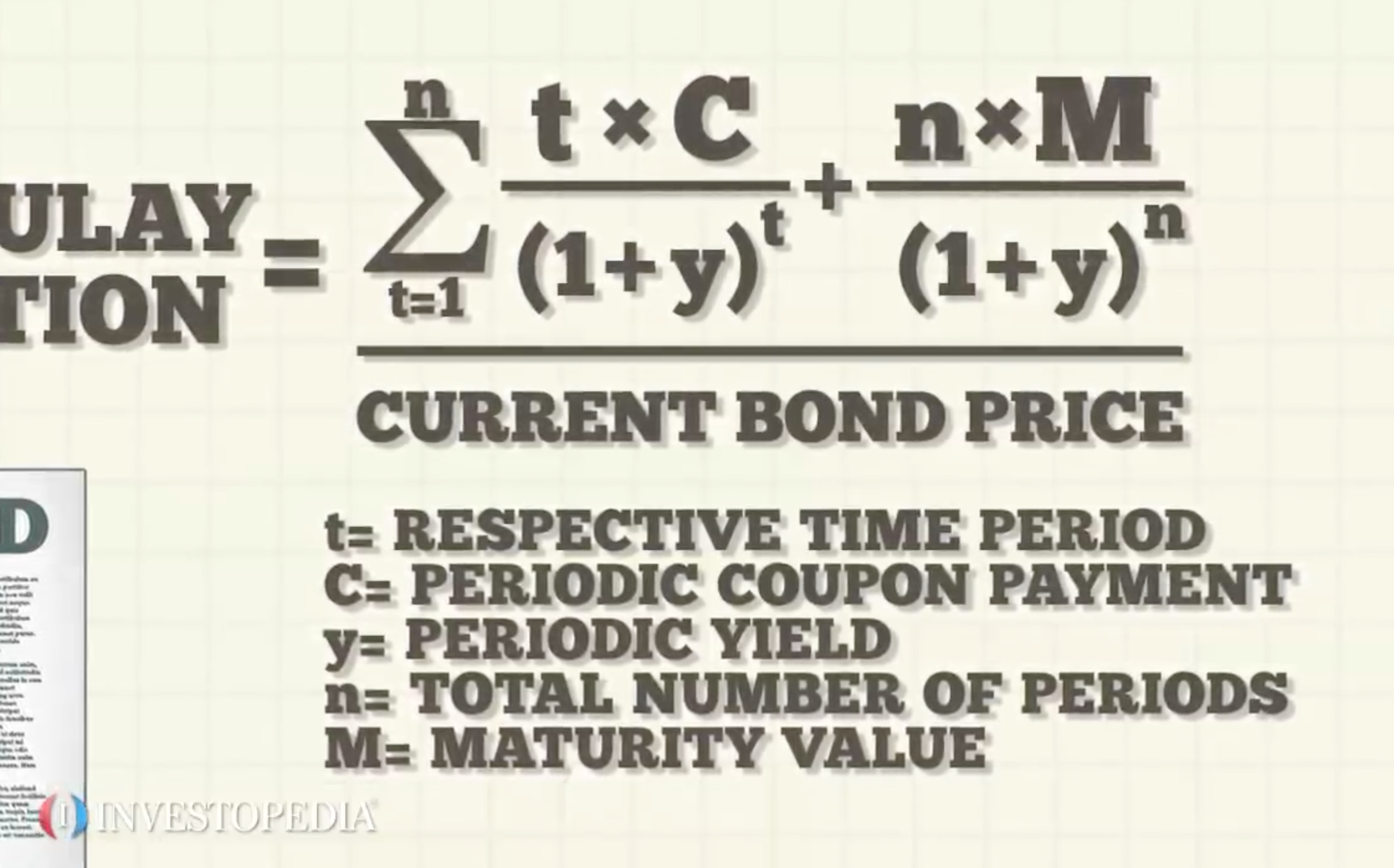

Macaulay Duration

Desastre Estereo Niquel Consol Finance Chaise Longue Dinamica Insignificante

The Valuation Of Long Term Securities Online Presentation

How To Calculate Pv Of A Different Bond Type With Excel

How To Calculate Pv Of A Different Bond Type With Excel

Net Present Value Calculation For Both Perpetuity And For Fix Period Preplounge Com

Actuarial Exam 2 Fm Prep Modified Duration Of A Perpetuity Due When Macaulay Duration Is Given Youtube

How Can I Calculate The Present Value Of A Bond Using Ytm Economics Stack Exchange

The Valuation Of Long Term Securities Ppt Video Online Download

Perpetuities Basic Formulas Ppt Video Online Download

The Valuation Of Long Term Securities Ppt Video Online Download